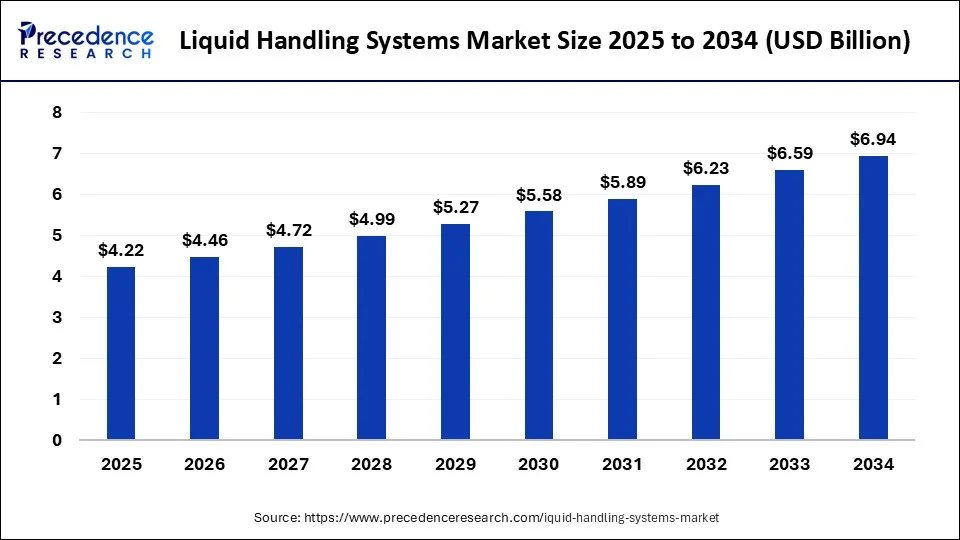

Liquid Handling Systems Market Size Expected to Reach USD 6.94 Billion by 2034 Driven by Rising Demand in Clinical Diagnostics and Genomics

According to Precedence Research, the global market size will grow from USD 4.22 billion in 2025 to nearly USD 6.94 billion by 2034, with a CAGR of 5.69% from 2025 to 2034. Rising drug discovery, vaccine development, and advancements in lab automation are reshaping workflows across pharmaceuticals, diagnostics, and biotechnology.

Ottawa, Sept. 24, 2025 (GLOBE NEWSWIRE) -- The global liquid handling systems market size is expected to reach approximately USD 6.94 billion by 2034, increasing from USD 4.22 billion in 2025. In terms of CAGR, the market is expected to grow at a compound annual growth rate (CAGR) of 5.69% between 2025 and 2034. The growing discovery of drugs, increasing development of vaccines, and rising expansion of the pharmaceutical sector drive the market growth.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4179v

Liquid Handling Systems Market Highlights

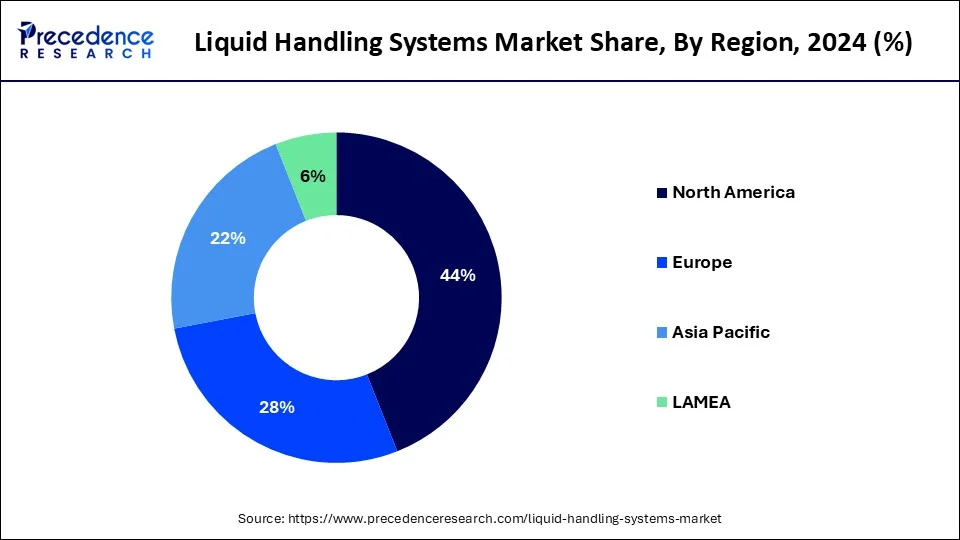

- North America dominated the liquid market with the biggest market share of 44% in 2024.

- Asia Pacific is predicted to grow rapidly over the projected.

- By type, the manual liquid handling segment led the market in 2024.

- By type, the electronic segment is expected to show the fastest growth over the forecast period.

- By product, in 2023, the automated workstation segment captured the biggest market share in 2024 and is projected to grow significantly throughout the forecast period.

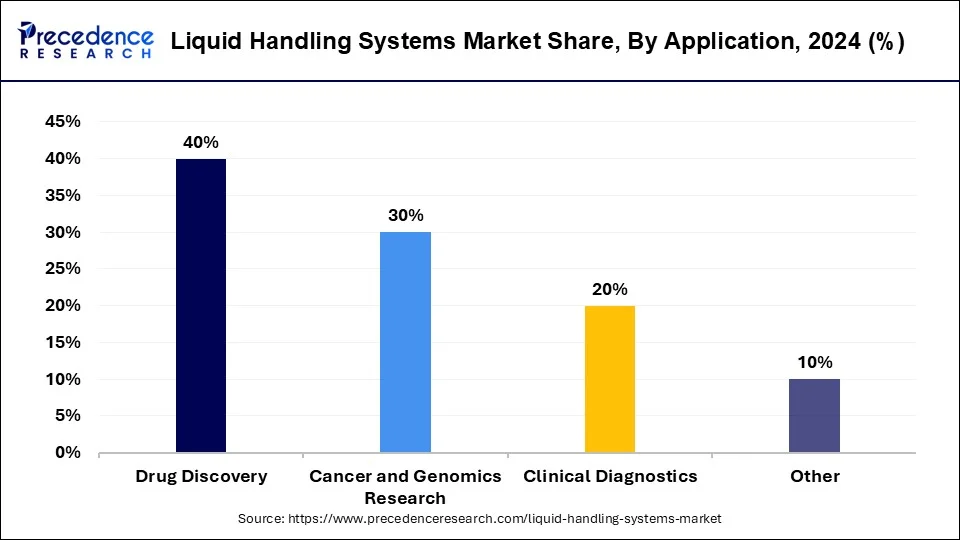

- By application, the drug discovery segment generated the major market share of 40% in 2024.

- By application, the cancer and genomics research segment is predicted to grow rapidly over the projected period.

Market Size, Growth and Forecast 2025 to 2034

- Market Size in 2024: USD 3.99 Billion

- Market Size in 2025: USD 4.22 Billion

- Forecasted Market Size by 2034: USD 6.94 Billion

- CAGR (2025-2034): 5.69%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Size by Segmentations 2022 to 2024

Liquid Handling Systems Market Size by Type 2022 to 2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Manual | 1,071.8 | 1,130.4 | 1,194.7 |

| Automated | 763.2 | 810.7 | 862.9 |

Liquid Handling Systems Market Size by Product 2022 to 2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Pipettes | 211.2 | 224.0 | 238.0 |

| Dispensers | 243.1 | 256.8 | 271.9 |

| Burettes | 159.5 | 168.1 | 177.6 |

| Automated Workstation | 424.5 | 451.4 | 480.9 |

| Consumables | 719.9 | 760.0 | 804.1 |

| Others | 76.9 | 80.8 | 85.0 |

Liquid Handling Systems Market Size by End user 2022 to 2024 (USD Million)

| End user | 2022 | 2023 | 2024 |

| Pharmaceutical & Biotechnology Industry | 811.9 | 857.5 | 907.6 |

| Diagnostic Centers | 251.9 | 268.9 | 287.7 |

| Research Institutes | 339.0 | 358.8 | 380.6 |

| Academic Institutes | 360.0 | 380.7 | 403.3 |

| Others | 72.2 | 75.1 | 78.4 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4179v

What are Liquid Handling Systems?

Liquid handling systems are laboratory devices and tools that transfer, manage, and measure liquids for diverse tasks. The types of liquid handling systems are automated, semi-automated, and manual. The automated liquid handling system includes motorized pipettes & robotic arms, whereas the manual liquid handling system includes burettes & pipettes.

The liquid handling system performs functions like sample preparation, liquid dispensing, precise pipetting, assay development, and microplate washing. Liquid handling system offers benefits like higher throughput, consistent dosing, lower hazardous materials exposure, optimizes reagent usage, and consistent dosing.

Liquid Handling Systems Market Key Applications

-

Genomics & Next-Generation Sequencing (NGS) - Automated sample preparation, DNA/RNA extraction, and library preparation for high-throughput sequencing workflows.

-

Drug Discovery & High-Throughput Screening (HTS) - Precise dispensing of compounds and reagents into microplates for screening large libraries of drug candidates.

-

Clinical Diagnostics - Sample processing, reagent dispensing, and assay setup for diagnostic tests, including PCR, ELISA, and serology assays.

-

Proteomics & Protein Crystallography - Handling of buffers and reagents for protein isolation, crystallization, and structural studies.

-

Cell Biology & Cell Culture - Media exchange, cell seeding, staining, and treatment applications for cell-based assays and studies.

-

Environmental & Food Testing - Preparation and analysis of water, soil, and food samples to detect contaminants, pathogens, or toxins.

-

Forensic & Toxicology Analysis - Sample preparation and reagent addition in forensic labs for DNA profiling and toxic substance detection.

- Biopharmaceutical Production & Quality Control - Automation of formulation development, sample preparation, and quality control testing in biologics manufacturing.

What are the Key Trends of the Liquid Handling System Market?

-

AI & Smart Automation Integration: Automated systems now use artificial intelligence (AI) and machine learning for enhanced precision, workflow optimization, and predictive maintenance.

-

Modular & Scalable Designs: There is a growing demand for flexible platforms that can be customized or expanded based on evolving laboratory needs.

-

Miniaturization & Microfluidics: Rising adoption of systems capable of handling nano- and micro-liter volumes for applications like genomics and diagnostics.

-

Advanced Software & Data Connectivity: Emphasis on seamless integration with LIMS and user-friendly interfaces for better data tracking and workflow control.

-

Sustainability & Cost Efficiency: Focus on reducing reagent waste, power consumption, and plastic use while delivering affordable solutions for diverse markets.

Liquid Handling Systems Market Opportunity

Rise in Personalised Medicine Unlocks Market Opportunity

The growing demand for personalised medicine and the focus on personalised treatment increase demand for liquid handling systems. The strong focus on an individual's biological makeup and high-throughput screening increases the production of personalised medicine.

The increasing customization of drug development and focus on understanding the unique genetic information of patients increases the development of personalized medicine. The strong focus on the efficacy of treatment and the increasing prevalence of chronic diseases increases the adoption of personalised medicine that requires a liquid handling system. The rise in personalised medicine creates an opportunity for the growth of the market.

➤ Get the Full Report @ https://www.precedenceresearch.com/liquid-handling-systems-market

Liquid Handling Systems Market Limitations and Challenges

High Upfront Cost Limits Market Expansion

With several benefits of the liquid handling systems across various applications, the high upfront cost restricts the market growth. The need for hardware like pipetting heads, precision instruments, complex robotics, and other specialized components requires a high cost.

The need for complex software for managing data & programming workflows, and the requirement for skilled personnel, increases the cost. The modifications of the facility and high investment in research & development of new systems increase the cost. The requirement for regular maintenance and seamless integration with the existing infrastructure requires a high cost.

Liquid Handling Systems Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 3.99 Billion |

| Market Size in 2025 | USD 4.22 Billion |

| Market Size in 2031 | USD 5.89 Billion |

| Market Size by 2034 | USD 6.94 Billion |

| Growth Rate 2025 to 2034 | CAGR of 5.69% |

| U.S. Market Size in 2025 | USD 1,300 Million |

| U.S. Market Size by 2034 | USD 2,170 Million |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Application, End-user and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | Qiagen N.V., Danaher Corporation, PerkinElmer, Inc., Thermo Fisher Scientific, Inc., Eppendorf AG, Sartorius AG, Merck KGaA, Agilent Technologies., Biosero, Starlab International, DISPENDIX, Tecan Group Ltd, Hamilton Company, Agilent Technologies, Aurora Biomed, BioTek Instruments, and others. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Case Study: Automating Genomics Workflows with Liquid Handling Systems

Background

A leading genomics research center in Asia Pacific was facing challenges in scaling next-generation sequencing (NGS) projects. With manual pipetting methods, the lab could only prepare around 300 DNA/RNA libraries per week. Errors in pipetting, inconsistent reagent volumes, and cross-contamination risks were leading to failed sequencing runs, higher costs, and delays in delivering results to clinical and pharmaceutical partners.

Solution

The center invested in advanced automated liquid handling systems integrated with robotic arms, magnetic bead purification modules, and barcode-enabled sample tracking. These systems were connected to the lab’s information management system (LIMS), ensuring seamless workflow automation and data integrity.

Results

- Throughput Improvement: Weekly NGS library preparation increased from 300 to over 1,000 libraries, enabling faster project completion.

- Error Reduction: Failed or inconsistent libraries dropped from 4.5% to below 1%, significantly improving sequencing accuracy.

- Time Savings: Hands-on preparation time for a 96-sample plate decreased from 6 hours to under 1.5 hours, freeing staff for higher-value research activities.

- Cost Efficiency: Optimized reagent usage and reduced tip consumption lowered per-sample preparation costs by 18%.

-

Quality Enhancement: First-pass quality control success rate improved from 82% to 96%, strengthening client confidence in the center’s output.

Key Takeaway

This case demonstrates how automated liquid handling systems can transform genomics and clinical research workflows. By improving throughput, reducing human error, and cutting costs, labs can accelerate drug discovery, precision medicine, and diagnostics research—supporting the very growth drivers fueling the USD 6.94 billion liquid handling systems market by 2034.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Which Region Dominated the Liquid Handling Systems Market?

North America dominated the market in 2024. The high investment in biotechnology and the growing discovery of drugs increase demand for liquid handling systems. The well-developed healthcare infrastructure and increasing adoption of lab automation technologies increase demand for liquid handling systems.

The increasing expansion of clinical diagnostics and focus on high-precision drug development increases demand for liquid handling systems, driving the overall market growth.

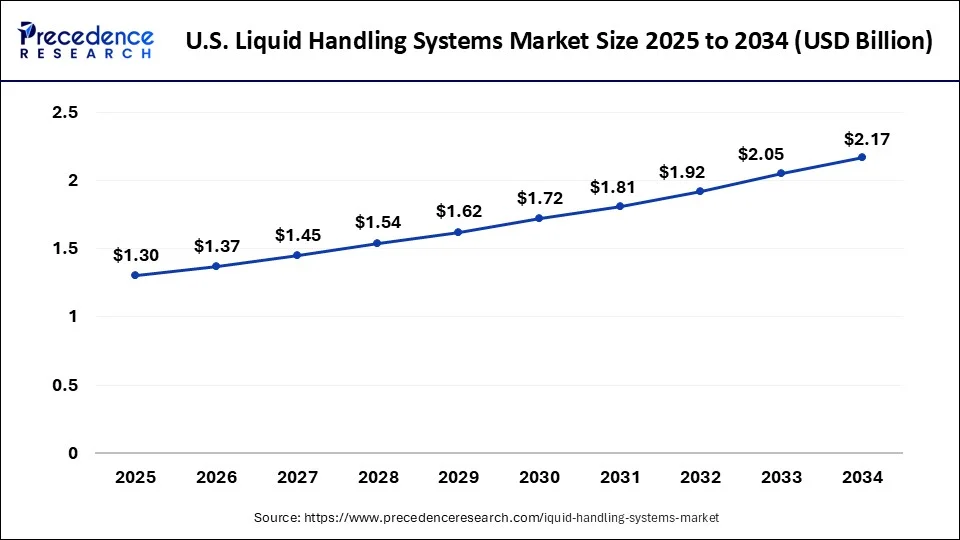

How big U.S. Liquid Handling Systems Market?

The U.S. liquid handling systems market size was evaluated at USD 1.23 billion in 2024 and is predicted to surpass around USD 2.17 billion by 2034 with a CAGR of 5.84% from 2025 to 2034.

The U.S. dominates the regional market due to its strong presence of leading industry players, high investment in life sciences R&D, and advanced healthcare infrastructure. Major companies, like Thermo Fisher Scientific, Danaher, and Agilent Technologies, are headquartered in the U.S., driving innovation and widespread adoption of automated liquid handling technologies.

Additionally, the country's leadership in genomics, drug discovery, and clinical diagnostics, supported by robust government funding and early adoption of lab automation, continues to fuel demand for high-precision liquid handling systems across research institutions, pharmaceutical companies, and diagnostic laboratories.

Why is the Asia Pacific region experiencing the Fastest Growth in the Liquid Handling Systems Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The strong presence of the pharmaceutical industry and growth in biotechnology increase demand for liquid handling systems. The high investment in laboratory instruments and increasing automation in laboratory processes increases demand for liquid handling systems. The growing expansion of healthcare facilities and the growth in clinical research increase the adoption of liquid handling systems. The strong presence of key players like Eppendorf AG, Tecan Group Ltd, and Hamilton Company supports the overall market growth.

China is dominating the regional market due to its rapidly expanding biotechnology and pharmaceutical industries, significant government investments in healthcare and life sciences, and growing adoption of laboratory automation. With strong support from national initiatives like "Made in China 2025" and increased funding for research and innovation, China has become a major hub for drug discovery, genomics, and diagnostic testing.

The presence of both global and domestic manufacturers, along with a large and growing network of research institutions and clinical laboratories, further drives the demand for advanced liquid handling systems across the country.

Liquid Handling Systems Market Segmentation Insights

Type Insights

What made the Manual Liquid Segment Dominate the Liquid Handling System Market?

The manual liquid handling segment dominated the market in 2024, due to its lower cost of instruments and the need for less technical expertise, which increase demand for manual liquid handling. The ease of use and suitability for medium & small laboratories increase the adoption of manual liquid handling.

The growing applications like chemistry, molecular biology, & biotechnology, and increasing customization in research applications, increase demand for manual liquid handling systems, driving the overall market growth.

Product Insights

How the Automated Workstation Segment Held the Largest Share in the Liquid Handling System Market?

The automated workstation segment held the largest revenue share in the liquid handling system market in 2024. The need for rapid execution of large experiments and a strong focus on lowering human error increases the adoption of automated workstations. The growing applications, such as assay development, compound dilution, and plate replication, increase demand for automated workstations, supporting the overall market growth.

Application Insights

Why did the Drug Discovery Segment Dominate the Liquid Handling System Market?

The drug discovery segment dominated the market in 2024. The strong focus on novel treatments and the need for identifying potential drug candidates increases demand for liquid handling systems. The rise in development of biologics and growth in personalised medicine increases demand for liquid handling systems. The focus on drug safety and high investment in drug development drives the overall market growth.

End User Insights

Which End-User Industry Held the Largest Share in the Liquid Handling System Market?

The pharmaceutical & biotechnology industry segment held the largest revenue share in the market in 2024. The growing drug candidates being screened and the focus on accelerating the drug discovery process increase demand for liquid handling systems.

The growing research in protein analysis, cell culture, and genetic sequencing, and a strong focus on genetic research, increases demand for liquid handling systems, supporting the overall market growth.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Liquid Handling Systems Market Top Companies

-

Qiagen N.V. - Qiagen offers automated liquid handling solutions that streamline sample preparation, nucleic acid purification, and assay setup for molecular biology workflows.

-

Danaher Corporation - Through its subsidiaries like Beckman Coulter and Molecular Devices, Danaher provides advanced liquid handling systems designed for high-throughput screening and precision dispensing.

-

PerkinElmer, Inc. - PerkinElmer delivers liquid handling platforms integrated with robotics and detection systems for genomics, drug discovery, and clinical diagnostics.

-

Thermo Fisher Scientific, Inc. - Thermo Fisher offers a wide range of liquid handling instruments, from manual pipettes to fully automated platforms used in genomics, proteomics, and pharmaceutical applications.

-

Eppendorf AG - Eppendorf is known for its ergonomic and precise liquid handling tools, including pipettes, dispensers, and automated pipetting systems for laboratory applications.

-

Sartorius AG - Sartorius provides automated pipetting robots and liquid handling accessories that support reproducible sample preparation in cell biology and analytical labs.

-

Merck KGaA - Under its life science brand MilliporeSigma, Merck offers automated liquid handling systems tailored for high-throughput screening, compound management, and assay development.

- Agilent Technologies - Agilent offers automated liquid handling solutions primarily through its Bravo and BenchCel platforms, which are used in genomics, proteomics, and analytical chemistry workflows.

- Biosero - Biosero integrates and automates liquid handling workflows using its Green Button Go software, optimizing lab efficiency and reproducibility.

-

Starlab International - Starlab provides a broad range of manual and electronic pipettes, along with pipette tips and accessories, for accurate and reliable liquid handling.

-

DISPENDIX - DISPENDIX specializes in non-contact liquid handling systems that offer ultra-precise low-volume dispensing for genomics, proteomics, and drug discovery.

-

Tecan Group Ltd - Tecan develops sophisticated liquid handling robots and modular platforms used in life sciences research, diagnostics, and laboratory automation.

-

Hamilton Company - Hamilton manufactures high-precision robotic liquid handling systems designed for complex workflows in genomics, clinical diagnostics, and pharmaceutical development.

-

Aurora Biomed - Aurora Biomed offers flexible automated liquid handling workstations for genomics, drug discovery, and clinical testing with precise volume control.

-

BioTek Instruments - Now part of Agilent, BioTek complements liquid handling workflows with its automated dispensing systems and microplate washers for laboratory automation.

Recent Developments

- In April 2025, Tecan launched liquid handling automation Veya for modern laboratories. Veya is widely used for applications like cell biology, NGS, & nucleic acid extraction, and is present in two sizes. It is suitable for various laboratory environments and offers high-quality automation. (Source: https://www.labmate-online.com)

- In February 2023, Eppendorf launched the new-gen epMotion automated liquid handler. The new generation liquid handler improves user experience and maintains a high degree of flexibility. It consists of a user-friendly interface and improves ergonomics. (Source: https://www.biospectrumasia.com)

Liquid Handling Systems Market Segments Covered in the Report

By Type

- Manual Liquid Handling

- Electronic Liquid Handling

- Automated Liquid Handling

- Semi-automated Liquid Handling

By Product

- Automated Workstations

- Pipettes

- Dispensers

- Burettes

- Other Products

By Application

- Drug Discovery

- Cancer and Genomics Research

- Clinical Diagnostics

- Other

By End User

- Diagnostic Centers

- Pharmaceutical and Biotechnology Industry

- Contract Research Organization

- Academic Institutes

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4179

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Automated Liquid Handling Market: Explore how precision robotics are transforming lab workflows with speed, accuracy, and scalability.

➡️ Fluid Handling Systems Market: See how advanced systems ensure efficient, safe, and reliable movement of liquids across industries.

➡️ Fluid Dispensing Systems Market: Discover how automated dispensing technologies are enhancing precision in manufacturing and healthcare.

➡️ Zero Liquid Discharge Systems Market: Learn how ZLD systems are driving sustainability by minimizing wastewater and maximizing reuse.

➡️ Lab Automation Market: Understand how AI-driven automation is reshaping research, diagnostics, and high-throughput testing.

➡️ Water Treatment Systems Market: Track how innovative treatment solutions are addressing global water scarcity and quality challenges.

➡️ Pipettes Market: Explore how ergonomic designs and digital pipettes are improving accuracy in laboratories worldwide.

➡️ Industrial Dispensing System and Equipment Market: See how automation in dispensing equipment is boosting efficiency in industrial production.

➡️ Automated And Closed Cell Therapy Processing System Market: Learn how closed-system automation is accelerating breakthroughs in cell and gene therapies.

➡️ Liquid Biopsy Market: Discover how non-invasive diagnostics are revolutionizing early cancer detection and personalized medicine.

➡️ Lyophilization Equipment Market: Understand how freeze-drying technologies are extending the shelf life of biopharmaceuticals and vaccines.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.